A letter

fromScott Strazik

Our strengths

There is no company better positioned to serve and transform the electricity system on a global scale than GE Vernova. Our customers use our equipment to generate twenty-five percent of the world’s electricity—approximately one third of the world’s electricity excluding China—and nearly fifty percent of electricity in the United States.

The Advanced Materials & Coatings Technology team utilizing the forge lab in Niskayuna, New York.

Image credit: GE Vernova

A broad platform of solutions is central to growing the supply of electricity. There is no ‘single’ solution – it must be a mix across gas power, nuclear, wind, hydro, solar and storage, complemented by significant investments into the grid and software. The right solutions are local and unique to each customer depending on given resources and circumstances and we are well-positioned to offer our customers the solutions that are best for their specific needs. It is increasingly clear than an integrated system which prioritizes reliability, affordability, security, sustainability, and speed is essential. GE Vernova can deliver that platform.

Global customer demand is strong.

Our deep, decades-long relationships with utilities and power producers set GE Vernova apart. We see growing customer demand worldwide – from Saudi Arabia, transitioning from heavy fuel oil, where we secured more than $14 billion of commitments in 2025, to Taiwan, growing infrastructure to support chip manufacturing. In 2025, we signed our first gas new equipment contracts in Mexico in years, building on our large installed base in the country. We secured strong HA gas turbine orders in Malaysia, Poland, Mexico, and Kuwait, while rapidly growing grid equipment orders in Saudi Arabia, Iraq, Algeria, and Germany, and wind equipment orders in Australia, India, and Romania.

Nuclear has real momentum from North America to Poland, Sweden, and Finland. We made progress in the deployment of our first small modular reactor at the Darlington site in Ontario, Canada, where we began construction in the spring, with hundreds of workers now onsite every day. In late 2025, we announced a Memorandum of Understanding with the U.S. and Japanese governments to develop small modular reactors worth up to $100 billion. My conviction in the future value of our nuclear business continues to grow.

Gas power, which offers an ideal balance of speed, cost, performance, and scale that customers need, is in high demand. As an example, in Australia, gas power is critical in balancing the grid as renewable energy penetration grows rapidly across the country. Gas is also playing an important role as a baseload and flexible source of electrons – it also complements the demand profile needed for data centers. On a per-gigawatt basis, the two biggest costs for data centers will be for the chips and the power generation and electrical equipment, each at a premium relative to other building costs. The buildout of data centers will be a significant driver of gas turbine demand moving forward, and GE Vernova will offer substantial value to these customers who need electrons at unprecedented speed and scale.

GE Vernova can provide bridge power solutions today, while enabling conversations on more efficient heavy duty gas turbines, small modular reactors and carbon capture into the next decade. We continue to grow and expand our customer relationships with hyperscalers and other strategic electro-intensive industries. In the fourth quarter of 2025, we delivered our largest quarter of direct orders from hyperscalers in our Electrification segment; our grid equipment order growth is one of the most exciting parts of the GE Vernova story. Strong global customer demand for grid products ranging from switchgear, transformers, and synchronous condensers driven by renewable energy integration, industrialization, and other factors are all key growth areas for us.

A 7HA.03 gas turbine leaving Greenville, South Carolina.

Image credit: GE Vernova

Capacitive voltage transformers assembly in Charleroi, Pennsylvania.

Image credit: GE Vernova

With slower growth expected in the U.S. onshore wind market, our Wind segment is focused on executing our strategy which includes closing deals in key countries with strong services opportunities, expanding our repowering support in the U.S., delivering on our workhorse turbine platform, and executing our offshore backlog. We are confident in our focus here.

While our position as an American company enables us to invest and build on our leadership position in the U.S., we are also investing in our global footprint across our businesses. Delivering solutions that meet our customers’ specific needs is where we create value, and we are serving strong markets that are only getting stronger.

Operating from a position of financial strength.

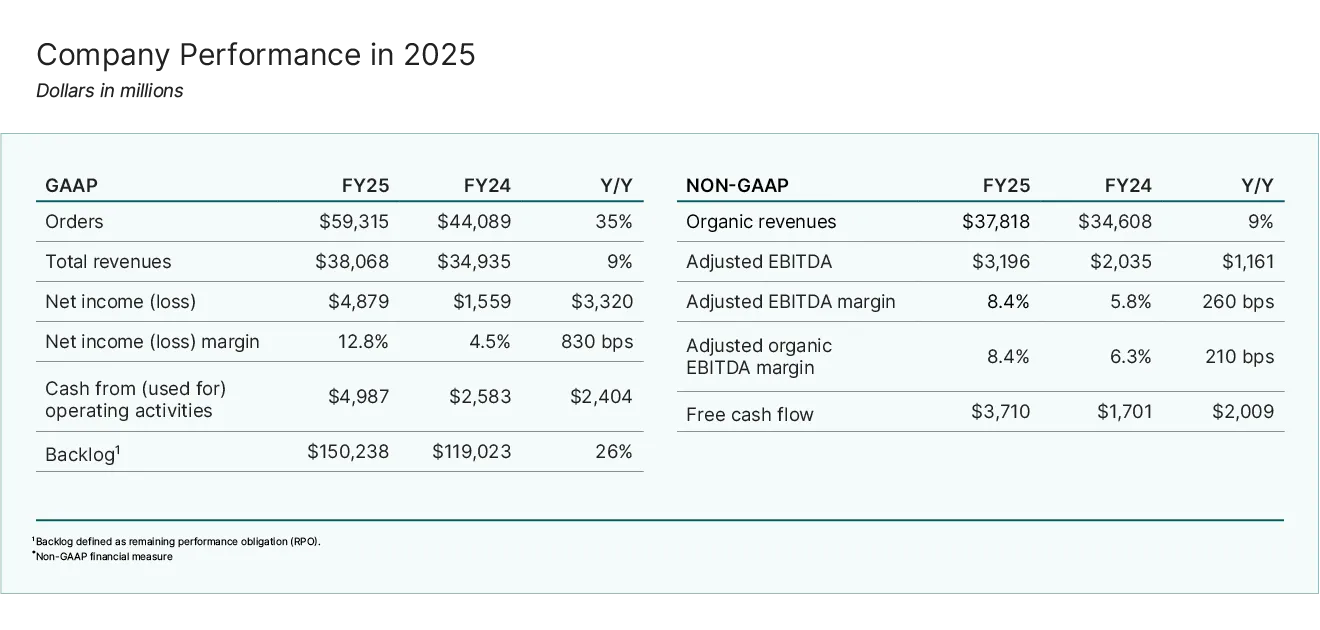

GE Vernova delivered strong performance in 2025. Our healthy and growing backlog grew more than 25 percent to $150 billion, up $31 billion in 2025, providing shareholders visibility to increasing revenue and earnings. Our equipment margins in backlog increased significantly in 2025, building on strong growth from 2024. Our financial strategy remains unchanged driven by disciplined top line growth, solid underwriting, and continued growth in services. In 2025, GE Vernova delivered orders of $59 billion, revenue of $38 billion, adjusted EBITDA* of $3.2 billion, and free cash flow* of $3.7 billion.

We executed on our capital allocation principles with our strong investment grade balance sheet, including investing for organic growth, returning one third of cash generation to shareholders, and targeted M&A. We maintain a robust cash position bolstered in 2025 by strategic moves to generate cash, simplify our portfolio, and invest in our core businesses. Since the spin, we’ve created approximately $2.5 billion from completed or announced dispositions simplifying the portfolio with negligible financial trade-offs. These moves allowed us to reinvest in our core with the acquisition of Woodward’s combustion parts business to scale our Gas Power supply chain buildout and our announced acquisition of the remaining 50% stake of our Prolec GE joint venture with Xignux for $5.3 billion. These are highly accretive acquisitions in our fastest growing businesses that will further empower us to accelerate growth and expand margins in our core.

We returned $3.6 billion of capital to shareholders through share repurchases and dividends in 2025. Given our strong cash position and growth trajectory, in December, we doubled our annual dividend to $2 per share and increased our buyback authorization from $6 billion to $10 billion.

We continue to accelerate our cost reduction plans to reach $600 million of G&A cost out by 2028 or earlier, and we do not expect to stop there.

Our strong business model is built on a vast installed base

with growing services.

A LM2500Xpress aeroderivative gas turbine engine in Veresegyház, Hungary.

Image credit: GE Vernova

Vernova maintains an installed base of more than 7,000 gas turbines—the largest in the world—and 59,000 wind turbines. Our installed base, when combined with our existing $86 billion services backlog, positions GE Vernova to grow our services revenue in the coming years.

In Electrification, our equipment backlog has more than quadrupled to $35 billion in just four years—and we expect this backlog to double again by 2028. This is a primary driver for our growth story which is not tied to any one power generation source. We are also expanding into new adjacencies—such as providing equipment directly within data centers.

Our high-margin services backlog will deliver significant free cash flow* to reinvest organically. We see substantial growth in both Electrification and services.

We are a highly diversified electrical equipment and services provider uniquely ready for this growth moment.

Image credit: GE Vernova

AI-powered wind turbine crawler for blade manufacturing inspection in Niskayuna, New York.

Image credit: GE Vernova

We are driving operational strength and investing into our manufacturing footprint.

Our focus is to maximize output from our existing factories through the deployment of lean lines, robotics, and advanced automation. Lean continues to enable us to increase output. Lean is embedded in our culture and drives our operational execution every day, and while we are pleased with our progress, we are still early in this journey.

We are investing $11 billion for the future in capex and R&D from 2025 through 2028, including $1 billion for Prolec GE from 2026 to 2028.

In 2025, we’ve hired more than 1,500 incremental production workers across the U.S. in our Power and Electrification segments to grow capacity and increase output from our same factory footprint. Every Monday, two dozen new employees show up ready to work in our U.S. factories. New U.S. labor contracts provide healthy raises for our workers and add weekend shifts to increase our output.

We are investing in our factories. In Greenville alone, we have installed over two hundred new machines this year and will invest in two hundred more in 2026. Across our grid factories in Pennsylvania, we are investing more than $100 million over the next two years and adding seven hundred jobs to manufacture more high voltage switchgear products, which are critical components for stable and reliable grid infrastructure.

In Southeast Asia, we are investing $20 million to develop next-generation repair capabilities for HA gas turbines at our Global Repair Service Center in Singapore. In Hungary, we are increasing plant capacity while improving technology and site energy efficiency.

In 2026, we will continue to assess and deploy investments into factories that have demonstrated an ability to fully utilize lean to eliminate waste and, with that, earn the right for future capex.

Our Advanced Research Center is focused on scaling horizontal application of AI and robotics across GE Vernova to increase productivity. We are also developing, industrializing and scaling new businesses and innovating breakthrough products including carbon capture, fuel cells, and solid state transformers for data centers. R&D investments also include our small modular reactor and grid software platform, both of which we expect to deliver strong returns in the next decade. These are not hobbies; we have significant ambition to develop and grow these revenue streams.

Nuclear fuel pellet manufacturing, Wilmington, North Carolina.

Image credit: GE Vernova

As a team, we have benefitted from the significant momentum created by GE Vernova in 2025, and we are giving back to the global communities where we live and work.

In 2025, the GE Vernova Foundation advanced our two priorities, creating the STEM workforce of the future and building more resilient communities, while growing our global presence. We now have programming in thirty countries and have reached close to nine thousand learners, launching initiatives in communities where GE Vernova operates to help develop the talent needed for a more sustainable energy future. With strong momentum behind us, we remain focused on our goal to train thirty thousand students and learners by 2030 providing them with the skills and knowledge to excel in the energy industry.

GE Vernova also committed to invest $50 million over five years as part of an alliance with the Massachusetts Institute of Technology (MIT) to accelerate cutting-edge technologies and foster the next generation of power industry leaders. We are working with MIT to bring together faculty, researchers, and students to address some of the most pressing challenges in energy and climate technology while developing the energy sector’s future workforce, with GE Vernova funding thirteen projects on cutting-edge research. I begin each day incredibly excited knowing we are creating the next generation of energy leaders who will work on solving some of the world’s greatest challenges. We are committed to investing in programs and opportunities to help grow skills and encourage future leaders to choose careers in the energy sector.

In December, we set a new GUINNESS WORLD RECORD™ for the Largest Online Toy Drive in 24 Hours, aimed at inspiring the next generation of STEM leaders. We are reinvesting into global communities—from our sponsorship of Greenville, South Carolina’s Triumph soccer team, and Saratoga Springs, New York’s Jazz Festival, to the construction of a community center in Tunuyan, Argentina—and working to make an impact all over the world.

2025 is an early stage of this multi-decade transformation of our electrical system. Opportunities abound for GE Vernova to create long-term value. We are building a unique, purpose-built, differentiated company that provides investors the best opportunity to gain exposure to the electricity supercycle.

Path forward

Our path forward is driven by GE Vernova’s strategic imperatives

Onshore wind turbine blade assembly in Grand Forks, North Dakota.

Image credit: GE Vernova

Our first priority is building and motivating the Highest-Performing Team to achieve our goals. Our teams are run with an unapologetic focus on prioritizing what creates value, while eliminating work that doesn’t. We will attract, develop, energize, motivate, and compensate top talent to deliver results. Our teams are empowered to make decisions and act with urgency. We will continue to upskill and develop our talent and culture, all while committing to fatality-free operations.

Second, we will drive Profitable Customer Expansion by creating valuable solutions and growing and investing in our relationships with current and new customers. We have strong partnerships with many of the world’s largest utilities in the most important markets and we will strengthen these while we expand our support for new high-growth customer archetypes including hyperscalers, data center developers, private equity, engineering, procurement and construction firms (EPCs) and oil and gas companies. We are investing in the U.S., Europe, Saudi Arabia, India, and other important markets to support our customers.

Third, we will deliver Innovation and Business Development for Durable and Diversified Revenue. We are creating new revenue streams by investing significantly in R&D and driving a multi-pronged innovation strategy that will enhance our core products, accelerate high-growth business lines, and develop next-generation technology platforms. We are balancing short-term competitiveness with long-term growth across products and markets, underpinned by a strong return case for every dollar invested

Fourth, we will harness Exponential Technology and Data for Breakthrough Impact to fundamentally transform how the company operates, from product design and engineering to delivery and customer service. Our large installed base generates significant proprietary data which when combined with significant investments in AI can unlock enormous value for GE Vernova and our customers. We are early in our deployment of automation and robotics but are making meaningful advances every year, and we will arm our employees with AI assistants to drive further productivity. As an organization, GE Vernova will become faster, more efficient, and more effective as we deliver this transformation.

Fifth, we will underpin this with Operational Excellence and Financial Performance. Our efforts are guided by Safety, Quality, Delivery, and Cost—in that order—and we will assess every one of our sites on lean practices, capacity, infrastructure, and capability. Operational excellence around quality remains a key continuous improvement opportunity for the company. In 2025, GE Vernova launched the Zero-Defect Framework, which is our roadmap to deliver best-in-class customer value through the quality of our products, services, and solutions. We are delivering for customers, shareholders, and our team as we enter this period of sustained, rapid growth.

Just the Beginning

The electrical sector is in the early stages of a multi-decade journey, one with massive global and societal implications. It is also early for GE Vernova: we delivered a productive 2025 and created significant value for customers, shareholders, and our team—but it is just a start.

2026 will be another important year for GE Vernova and our industry. We enter the year with great optimism and a clear sense of pragmatic purpose and responsibility. While we delivered much in 2025, what excites me every day is our potential for the future.

I'm proud and humbled by all we’ve accomplished as a team and company in 2025. Thank you to our GE Vernova team of approximately 75,000 employees across the world.

Thank you for your investment in our company and for your continued support – we are just getting started.

Scott Strazik

President and CEO, GE Vernova

FORWARD-LOOKING STATEMENTS

This document includes forward-looking statements. Please reference the “Forward-Looking Statements” section of the Form 10-K included in this Annual Report to Stockholders.

NON-GAAP FINANCIAL MEASURES

We sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures can be found in the Management’s Discussion and Analysis section within our Form 10-K and in GE Vernova’s fourth quarter 2025 earnings materials posted to gevernova.com/investors, as applicable