Fourth Quarter 2025 Highlights:

- Orders of $22.2B, +65% organically with growth in all segments

- Backlog growth of $15.0B sequentially from equipment and services at Power and Electrification

- Gas Power equipment backlog and slot reservation agreements grew from 62 to 83 GW

- Revenue of $11.0B, +4%, +2% organically* with services growth in each segment

- Net income of $3.7B; net income margin of 33.5%; inclusive of a $2.9B tax benefit due to a U.S. valuation allowance release

- Adjusted EBITDA* of $1.2B and adjusted EBITDA margin* of 10.6%

- Cash from operating activities of $2.5B; free cash flow* of $1.8B

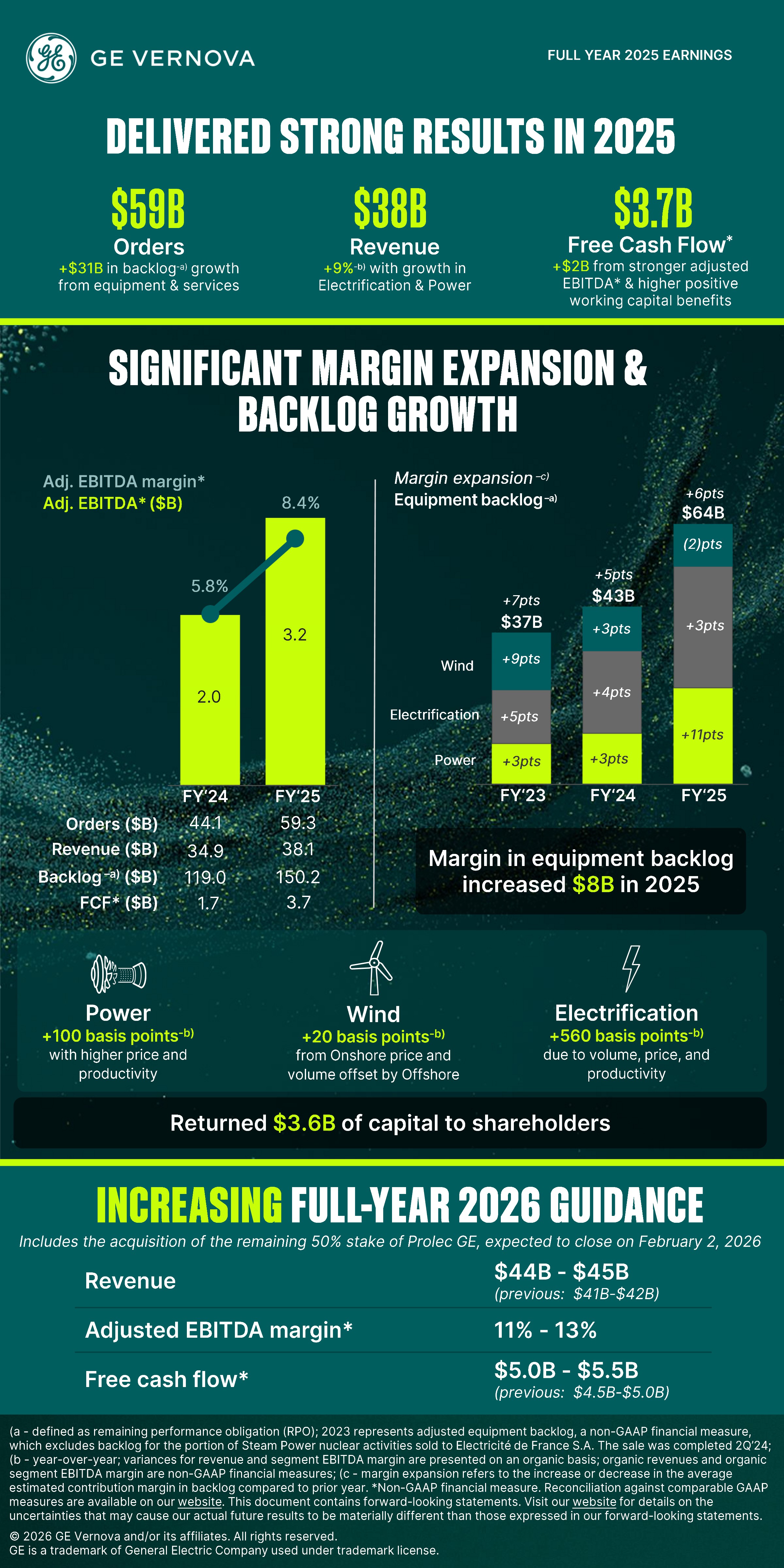

Full Year 2025 Highlights:

- Orders of $59.3B, +34% organically, led by equipment at Power and Electrification and services in each segment

- Total backlog growth of $31.2B year-over-year; grew equipment margin in backlog by $8B, with 6 pts of accretion

- Revenue of $38.1B, +9% on a U.S. GAAP basis and organically* driven by growth in Electrification and Power

- Net income of $4.9B; net income margin of 12.8%; inclusive of a $2.9B tax benefit due to a U.S. valuation allowance release

- Adjusted EBITDA* of $3.2B and adjusted EBITDA margin* of 8.4%

- Cash from operating activities of $5.0B; free cash flow* of $3.7B

- $8.8B cash balance; $3.6B in capital returned to shareholders

GE Vernova CEO Scott Strazik said: “We delivered strong financial performance in 2025 with continued momentum in Power and Electrification while focusing on what we can control in Wind. We increased our backlog to $150 billion, with better equipment margins, and are entering 2026 with significant momentum. Our platform of advanced solutions is well-positioned to serve the growing, long-cycle electric power market, and there is substantial opportunity to deliver even better performance ahead. I’m grateful for our team’s dedication and confident in our ability to meet our full potential today and for the long-term.”

GE Vernova CFO Ken Parks said: "We delivered a strong finish to 2025 as we executed our financial strategy, with robust quarterly orders, revenue growth, margin expansion, and significant free cash flow generation. We expanded our 2025 backlog across equipment and services, with equipment margin in backlog expanding six points year-over-year, reflecting favorable price and our continued focus on disciplined underwriting. Given our strong free cash flow generation, we ended the quarter with a healthy cash balance of nearly $9 billion, which continues to give us confidence to invest in our core businesses and return cash to shareholders through our share repurchase actions and quarterly dividend payment, while maintaining a strong investment grade balance sheet. Today, we’re also increasing our multi-year financial outlook to include Prolec GE.”

Multi-year financial outlook:

GE Vernova is increasing its 2026 financial guidance and outlook by 2028, which now includes the acquisition of the remaining fifty percent stake of Prolec GE:

- For 2026, GE Vernova now expects revenue of $44-$45 billion, up from $41-$42 billion, adjusted EBITDA margin* of 11%-13%, and free cash flow* of $5.0-$5.5 billion, up from $4.5-$5.0 billion

- For GE Vernova’s outlook by 2028, the company now expects revenue of $56 billion, up from $52 billion, with low-teens organic growth, adjusted EBITDA margin* of 20%, and cumulative free cash flow* of at least $24 billion, up from at least $22 billion

Overall, we are pleased with our financial performance in 2025 and are entering 2026 with significant momentum as we continue to serve the growing, long-cycle electric power market. We also look forward to connecting with you in the coming days and welcome any feedback on areas where we can improve. Please visit our website and sign up for email alerts to stay in touch with us. Thank you for your continued interest in GE Vernova.

Thanks,

The GE Vernova IR team

1Defined as remaining performance obligation (RPO)

2Compound annual growth rate through 2028; 2025 is the base year

*Non-GAAP Financial Measure. The reasons we use these non-GAAP financial measures and the presentations of and reconciliations to their most directly comparable GAAP financial measures are included in our fourth quarter 2025 earnings release and presentation slides posted on Investor Relations website at https://www.gevernova.com/investors.

This document contains forward-looking statements. Forward-looking statements provide current expectations of future events based on certain assumptions. Words such as “expects,” “intends,” “plans,” “guidance,” “outlook,”and similar expressions, may identify such forward-looking statements. Except as required by law, we disclaim any obligation to update any forward-looking statements.