-

Strong 2Q’24 results with margin expansion & substantial cash flow improvement; raising 2024 guidance

Second Quarter 2024 Highlights:

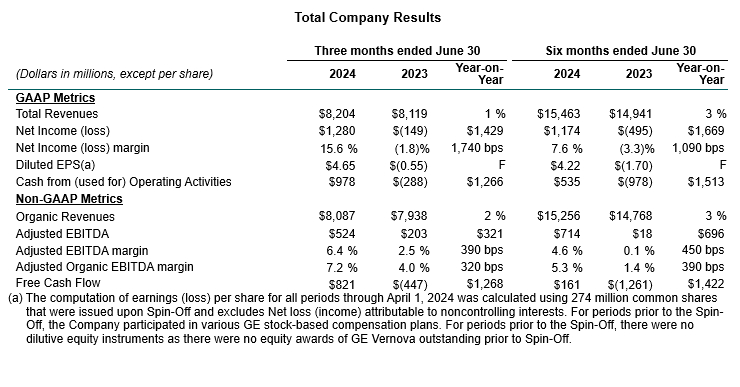

- Total orders of $11.8B exceeded revenue by 1.4X

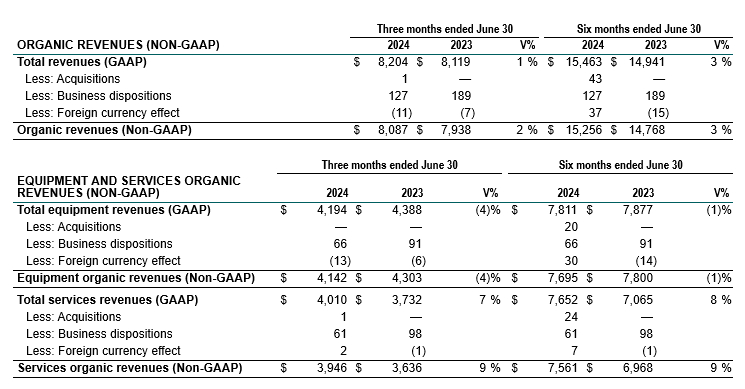

- Total revenue of $8.2B, +1%, +2% organically*, led by services growing +7%, +9% organically*

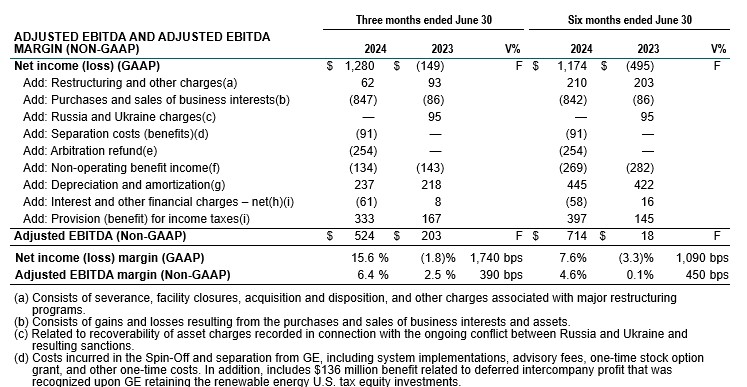

- Net income of $1.3B, +$1.4B; net income margin of 15.6%, +1,740 bps

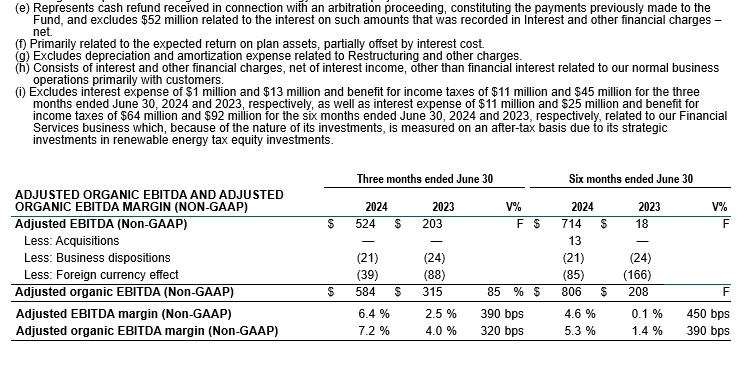

- Adjusted EBITDA* of $0.5B, +$0.3B organically*; adjusted EBITDA margin* of 6.4%, +320 bps organically*

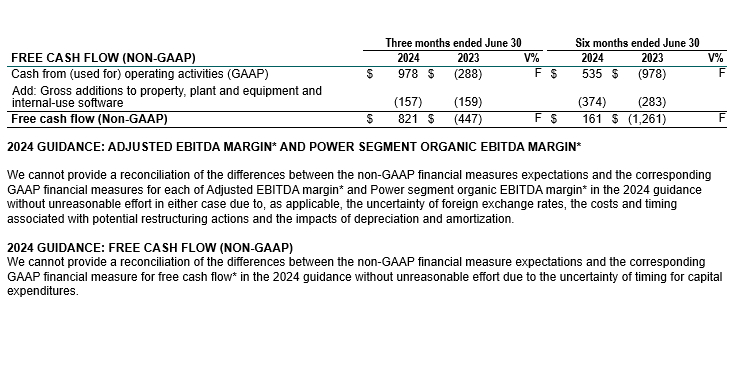

- Cash from operating activities of $1.0B, +$1.3B; positive free cash flow* (FCF) of $0.8B, +$1.3B, from working capital and increased adjusted EBITDA*

- $5.8 billion cash balance, up from $4.2 billion upon spin-off from GE on April 2

CAMBRIDGE, Mass., (July 24, 2024) – GE Vernova Inc. (NYSE: GEV), a unique industry leader enabling customers to accelerate the energy transition, today reported financial results for the second quarter ending June 30, 2024.

“GE Vernova delivered another strong quarter with EBITDA margin expansion across all segments and substantial cash improvement,” said GE Vernova CEO Scott Strazik. “Global electrification and decarbonization trends continue to drive demand for our products and services, and we are delivering value for our stakeholders. Our lean operating model is focused on improving safety, quality, delivery and cost as we execute for our customers and innovate breakthrough energy transition technologies. Given our strong first half performance and momentum in our Power and Electrification segments, we are raising our full-year 2024 guidance.”

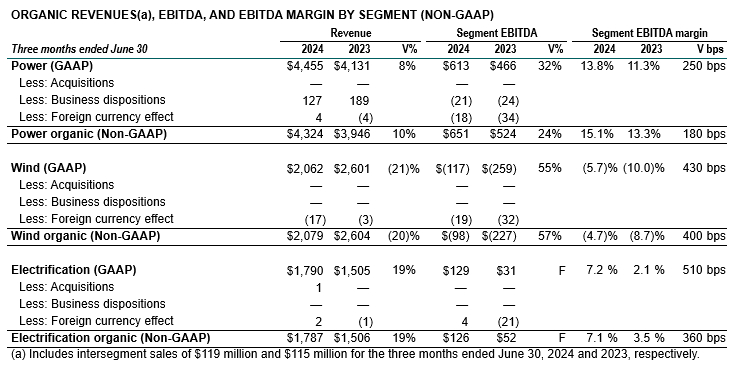

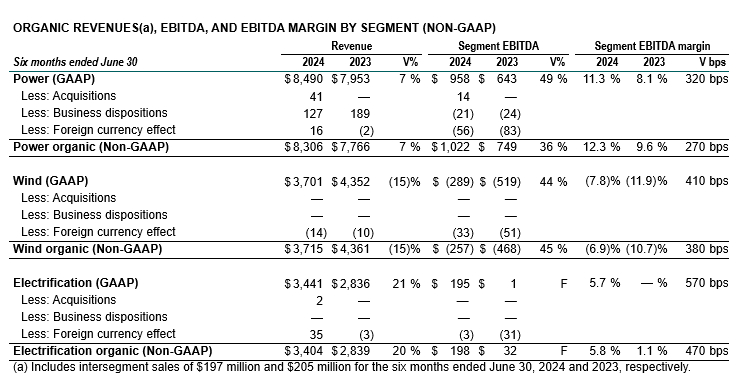

In the second quarter, GE Vernova orders of $11.8 billion decreased (7)% organically, primarily due to a large Offshore Wind equipment order in the second quarter of last year that was canceled in the fourth quarter. Services orders increased double-digits, led by Power and Electrification. Revenue of $8.2 billion was up +1%, +2% organically*, driven by continued strength in Electrification and Power and positive price in all three segments. Services revenue grew +7%, +9% organically*, with growth across all segments. Margins expanded by more than 300 basis points from productivity, price and services volume. Cash flow improved by more than $1.0 billion, sequentially and year-over-year, driven by working capital and adjusted EBITDA* growth.

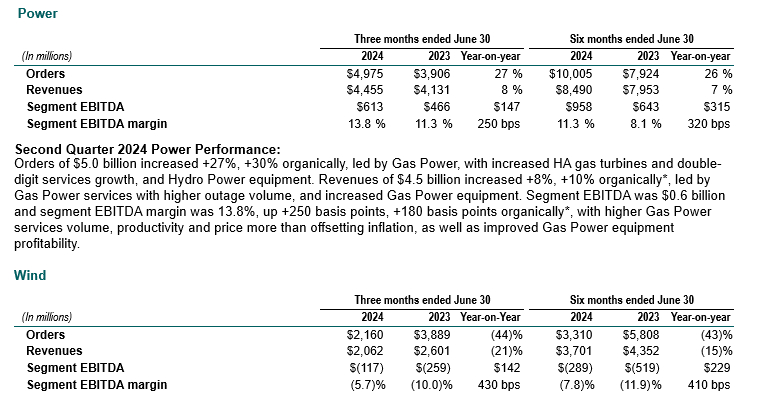

Power

- Orders of $5.0 billion increased +30% organically from Gas Power and Hydro Power equipment and double-digit services order growth. Revenues of $4.5 billion increased +8%, +10% organically*, led by higher Gas Power services and equipment.

- Commissioned its one hundredth HA gas turbine, part of the fastest growing fleet in the H-Class segment with the highest number of units ordered, bringing its global installed H-Class capacity to more than 53 gigawatts.

Wind

- Orders of $2.2 billion decreased (44)% organically, primarily driven by the large Offshore Wind order in the second quarter of last year and slightly lower Onshore Wind orders. Revenues of $2.1 billion decreased (21)%, (20)% organically*, from lower Onshore Wind deliveries, partially offset by Offshore Wind backlog[1] execution.

- Booked 1.8GW of wind turbine orders, including repowering, while continuing to implement selectivity, lean and pricing.

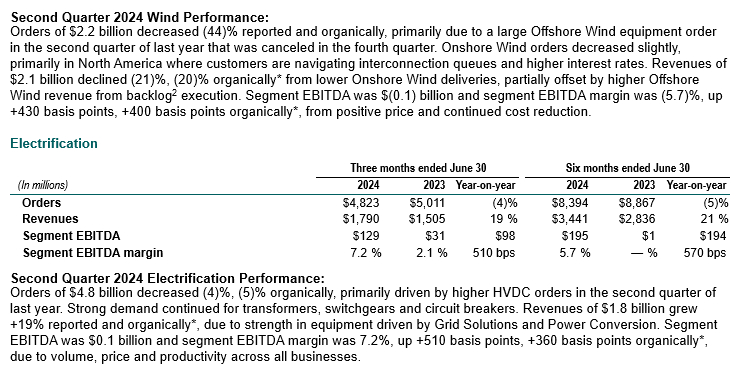

Electrification

- Backlog1 grew 35% year-over-year on orders of $4.8 billion, which decreased (5)% organically, primarily driven by higher High-Voltage Direct Current (HVDC) orders in the second quarter of last year. Revenues of $1.8 billion increased +19% reported and organically*, with strength in Grid Solutions and Power Conversion equipment.

- Secured a major order from Sonelgaz, through the GE Algeria Turbines (GEAT) joint venture, for high voltage grid equipment and solutions for 134 substations in Algeria by 2028.

Company Updates:

In the second quarter of 2024, GE Vernova:

- Experienced two fatalities and updated its Life Saving Rules as fatality-free operations remain a top priority.

- Completed the sale of part of its Steam Power nuclear activities to Electricité de France S.A. (EDF). In connection with the disposition, we received net cash proceeds of $0.6 billion, subject to customary working capital and other post-close adjustments. As a result, GE Vernova recognized a pre-tax gain of $0.9 billion.

- Invested $0.2 billion in capital expenditures to prepare for outages and increase capacity in Power and Electrification.

- Funded $0.2 billion in research and development (R&D) spending to continue advancing breakthrough energy transition technologies.

- Received approximately $0.3 billion, related to an outcome of an arbitration with a multiemployer pension plan (the Fund) that remains in dispute.

"We’re very encouraged by our first half results as we execute on our strategy to deliver disciplined revenue growth with increased profitability and positive cash generation. Strong working capital management and higher EBITDA drove significant cash improvement in the second quarter. Based on our performance, we are now trending towards the higher end of our revenue guidance for 2024 and have increased our expectations for adjusted EBITDA margins and free cash flow,” said GE Vernova CFO Ken Parks. “We remain focused on strategic capital allocation and are committed to maintaining our investment-grade balance sheet.”

Guidance:

GE Vernova is raising its 2024 financial guidance and now expects revenue to trend towards the higher end of $34-$35 billion and adjusted EBITDA margin* of 5%-7%, up from the higher end of mid-single digits. Additionally, GE Vernova now expects free cash flow* of $1.3-$1.7 billion, up from $0.7-$1.1 billion. Segment guidance is:

- Power: mid-single digit organic revenue* growth and ~150-200 basis points of organic EBITDA margin* expansion, up from ~100 basis points.

- Wind: flat organic revenue* growth, approaching profitability.

- Electrification: mid- to high-teen organic revenue* growth, up from low double-digits, and high single-digit EBITDA margin, up from mid-single digits.

Results by Reporting Segment

The following segment discussions and variance explanations are intended to reflect management’s view of the relevant comparisons of financial results.

Non-GAAP Financial Measures

The non-GAAP financial measures presented in this press release are supplemental measures of our performance and our liquidity that we believe help investors understand our financial condition and operating results and assess our future prospects. We believe that presenting these non-GAAP financial measures, in addition to the corresponding U.S. GAAP financial measures, are important supplemental measures that exclude non-cash or other items that may not be indicative of or are unrelated to our core operating results and the overall health of our company. We believe that these non-GAAP financial measures provide investors greater transparency to the information used by management for its operational decision-making and allow investors to see our results “through the eyes of management.” We further believe that providing this information assists our investors in understanding our operating performance and the methodology used by management to evaluate and measure such performance. When read in conjunction with our U.S. GAAP results, these non-GAAP financial measures provide a baseline for analyzing trends in our underlying businesses and can be used by management as one basis for financial, operational and planning decisions. Finally, these measures are often used by analysts and other interested parties to evaluate companies in our industry.

Management recognizes that these non-GAAP financial measures have limitations, including that they may be calculated differently by other companies or may be used under different circumstances or for different purposes, thereby affecting their comparability from company to company. In order to compensate for these and the other limitations discussed below, management does not consider these measures in isolation from or as alternatives to the comparable financial measures determined in accordance with U.S. GAAP. Readers should review the reconciliations below and should not rely on any single financial measure to evaluate our business. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Unless otherwise noted, tables are presented in U.S. dollars in millions, except for per-share amounts which are presented in U.S. dollars. Certain columns and rows within tables may not add due to the use of rounded numbers. Percentages presented in this report are calculated from the underlying numbers in millions.

We believe the organic measures presented below provide management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and foreign currency, which includes translational and transactional impacts, as these activities can obscure underlying trends.

We believe that Adjusted EBITDA* and Adjusted EBITDA margin*, which are adjusted to exclude the effects of unique and/or non-cash items that are not closely associated with ongoing operations provide management and investors with meaningful measures of our performance that increase the period-to-period comparability by highlighting the results from ongoing operations and the underlying profitability factors. We believe Adjusted organic EBITDA* and Adjusted organic EBITDA margin* provide management and investors with, when considered with Adjusted EBITDA* and Adjusted EBITDA margin*, a more complete understanding of underlying operating results and trends of established, ongoing operations by further excluding the effect of acquisitions, dispositions and foreign currency, which includes translational and transactional impacts, as these activities can obscure underlying trends.

We believe these measures provide additional insight into how our businesses are performing, on a normalized basis. However, Adjusted EBITDA*, Adjusted organic EBITDA*, Adjusted EBITDA margin* and Adjusted organic EBITDA margin* should not be construed as inferring that our future results will be unaffected by the items for which the measures adjust.

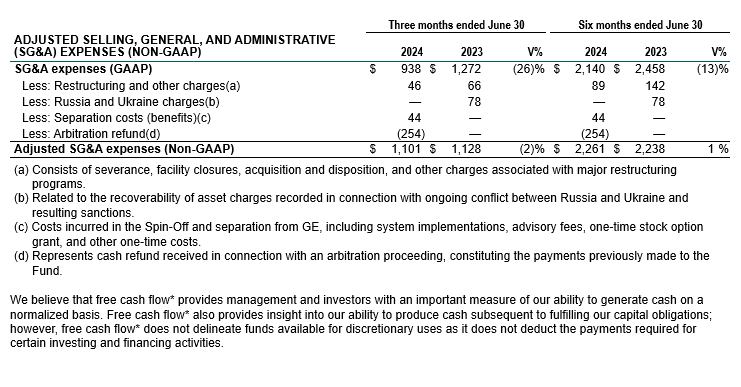

We believe Adjusted selling, general, and administrative expenses* provides investors with improved comparability of underlying operating results and a further understanding and additional transparency regarding how we evaluate our business. Adjusted selling, general, and administrative expenses* also provides management and investors with additional perspective regarding the impact of certain significant items on our expenses. Adjusted selling, general, and administrative expenses* excludes unique and/or non-cash items that can have a material impact on our results. However, Adjusted selling, general, and administrative expenses* should not be construed as inferring that our future results will be unaffected by the items for which the measure adjusts.

*Non-GAAP Financial Measure

[1] Defined as remaining performance obligation (RPO)

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this release and certain of our other public communications and SEC filings may constitute “forward-looking statements” that involve risks and uncertainties. Forward-looking statements are based on our current assumptions regarding future business and financial performance and condition. These statements by their nature address matters that are uncertain to different degrees, such as our expected future business and operating results and opportunities; our progress as an independent company; the demand for our products and services, the roles we expect them to play in the energy transition and our ability to meet those demands and execute those roles; our business strategy and the benefits we expect to realize; our expected operational improvements; our expectations regarding the energy transition; our investments; our expected cash generation; our capital allocation strategies; and our commitment to maintaining an investment grade rated balance sheet. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Words such as “anticipates,” “believes,” “expects,” “estimates,” “intends,” “plans,” “projects,” and similar expressions, may identify such forward-looking statements. Any forward-looking statement in this release speaks only as of the date on which it is made. Although we believe that the forward-looking statements contained in this release are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results, cash flows, or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

- Changes in macroeconomic and market conditions and market volatility, including risk of recession, inflation, supply chain constraints or disruptions, interest rates, the value of securities and other financial assets, oil, natural gas and other commodity prices and exchange rates, and the impact of such changes and volatility on the Company’s business operations, financial results and financial position;

- Global economic trends, competition and geopolitical risks, including impacts from the ongoing geopolitical conflicts (such as the Russia-Ukraine conflict and conflict in the Middle East), demand or supply shocks from events such as a major terrorist attack, natural disasters, actual or threatened public health pandemics or other emergencies, or an escalation of sanctions, tariffs or other trade tensions, and related impacts on our supply chains and strategies;

- Actual or perceived quality issues or product or safety failures related to our complex and specialized products, solutions, and services, the time required to address them, costs associated with related project delays, repairs or replacements, and the impact of any contractual claims for damages or other legal claims asserted in connection therewith, some of which may be for significant amounts, on our financial results, competitive position or reputation;

- Market developments or customer actions that may affect our ability to achieve our anticipated operational cost savings and implement initiatives to control or reduce operating costs;

- Significant disruptions in the Company’s supply chain, including the high cost or unavailability of raw materials, components, and products essential to our business, and significant disruptions to our manufacturing and production facilities and distribution networks;

- Our ability to attract and retain highly qualified personnel;

- Our ability to obtain, maintain, protect and effectively enforce our intellectual property rights;

- Our capital allocation plans, including the timing and amount of any dividends, share repurchases, acquisitions, organic investments, and other priorities;

- Downgrades of our credit ratings or ratings outlooks, or changes in rating application or methodology, and the related impact on the Company’s funding profile, costs, liquidity and competitive position;

- Shifts in market and other dynamics related to electrification, decarbonization or sustainability;

- The amount and timing of our cash flows and earnings, which may be impacted by macroeconomic, customer, supplier, competitive, contractual and other dynamics and conditions;

- Actions by our joint venture arrangements, consortiums, and similar collaborations with third parties for certain projects that result in additional costs and obligations;

- Any reductions or modifications to, or the elimination of, governmental incentives or policies that support renewable energy and energy transition innovation and technology;

- Our ability to develop and introduce new technologies to meet market demand and evolving customer needs, which depends on many factors, including the ability to obtain required permits, licenses and registrations;

- Changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs, regulation and incentives related to sustainability, climate change, environmental, health and safety laws, and tax law changes;

- Our ability and challenges to manage the transition as a newly stand-alone public company or achieve some or all of the benefits we expect to achieve from such transition;

- The risk of an active trading market not being sustained for our securities or significant volatility in our stock price; and

- The impact related to information technology, cybersecurity or data security breaches at GE Vernova or third parties.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements, and these and other factors are more fully discussed in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections included in our information statement dated March 8, 2024, which was attached as Exhibit 99.1 to a Current Report on Form 8-K furnished with the Securities and Exchange Commission (SEC) on March 8, 2024 as may be updated from time to time in our SEC filings and as posted on our website at www.gevernova.com/investors/fls. There may be other factors not presently known to GE Vernova or which we currently consider to be immaterial that could cause our actual results to differ materially from those projected in any forward-looking statement that we make. We do not undertake any obligation to update or revise our forward-looking statements except as required by applicable law or regulation. This press release also includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

Additional Information

GE Vernova’s website at https://www.gevernova.com/investors contains a significant amount of information about GE Vernova, including financial and other information for investors. GE Vernova encourages investors to visit this website from time to time, as information is updated, and new information is posted. Investors are also encouraged to visit GE Vernova’s LinkedIn and other social media accounts, which are platforms on which the Company posts information from time to time.

Additional Financial Information

Additional financial information can be found on the Company’s website at: www.gevernova.com/investors under Reports and Filings.

Conference Call and Webcast Information

GE Vernova will discuss its results during its investor conference call today starting at 7:30 AM Eastern Time. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the investor section of the website https://www.gevernova.com/investors. An archived version of the webcast will be available on the website after the call.

About GE Vernova

GE Vernova is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 75,000 employees across 100+ countries around the world.

GE Vernova’s mission is embedded in its name – it retains its legacy, “GE,” as an enduring and hard-earned badge of quality and ingenuity. “Ver” / “verde” signal Earth’s verdant and lush ecosystems. “Nova,” from the Latin “novus,” nods to a new, innovative era of lower carbon energy. Supported by the Company purpose, The Energy to Change the World, GE Vernova will help deliver a more affordable, reliable, sustainable, and secure energy future. Learn more: GE Vernova’s website and LinkedIn.

end

© 2024 GE Vernova and/or its affiliates. All rights reserved.

GE is a trademark of General Electric Company and is used under trademark license

Press Resources