Today, GE Vernova released its first quarter 2025 financial results. We had a strong start to 2025 with continued growth, margin expansion and significant cash generation, while executing our disciplined capital allocation strategy. We are reaffirming our 2025 financial guidance, including the impact of tariffs as currently outlined and resulting inflation, net of mitigating actions.

GE Vernova reports first quarter 2025 financial results

-

Strong 1Q'25 results with continued growth, margin expansion and significant cash generation

-

First Quarter 2025 Highlights:

- Orders of $10.2B, +8% organically, led by services +16% and Power equipment +43%

- Backlog growth of $4.4B[1] sequentially from equipment and services

- 29 gigawatts of Gas Power equipment in backlog, with 21 gigawatts of slot reservation agreements not yet in backlog

- Revenue of $8.0B, +11%, +15% organically* with growth in both equipment and services

- Net income of $0.3B, +$0.4B; net income margin of 3.3%, +480 bps

- Adjusted EBITDA* of $0.5B and adjusted EBITDA margin* of 5.7%

- Cash from operating activities of $1.2B, up $1.6B; free cash flow* of $1.0B, up $1.6B

- $8.1B cash balance; $1.3B in capital returned to shareholders

- Reaffirming 2025 guidance, including the estimated impact of tariffs as currently outlined and resulting inflation

CAMBRIDGE, Mass. (April 23, 2025) – GE Vernova Inc. (NYSE: GEV), a unique industry leader enabling customers to accelerate the energy transition, today reported financial results for the first quarter ending March 31, 2025.

“We delivered strong results in the first quarter and our businesses continued to execute well. We grew our equipment and services backlog, meaningfully improved margins in each segment, and are returning a significant amount of capital to shareholders,” said GE Vernova CEO Scott Strazik. “Our lean culture is enabling us to deliver on accelerating global electricity demand as we prioritize safety, quality, delivery, and cost. We are well-positioned to navigate the current dynamic environment, and we remain focused on creating value for stakeholders and investing in our future. I appreciate our customers’ continued trust in us and our team’s dedication and I’m excited for what’s ahead as we are only at the beginning of the electricity investment supercycle.”

"We had a strong start to 2025 as we continue executing our financial strategy, delivering disciplined revenue growth, margin expansion, and significant free cash flow in the first quarter. We generated positive free cash flow in the first quarter, a milestone for the GE Vernova businesses, reflecting strong down payments and working capital management resulting in further improvement in linearity,” said GE Vernova CFO Ken Parks. “We executed on our commitment to return cash to shareholders through our share repurchase actions and inaugural dividend payment, while maintaining a healthy cash balance and solid investment grade balance sheet. We are encouraged by our first quarter results and are reaffirming our 2025 financial guidance.”

Read full press release

*Non-GAAP Financial Measure. See the section titled “Non-GAAP Financial Measures” in the press release, which is accessible at the link above.

[1] Defined as remaining performance obligation (RPO)

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “guidance”, “will”, “may,” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about the benefits we expect from our lean operating model; our expectations regarding the energy transition; the demand for our products and services; our ability to navigate the current dynamic environment; the estimated impact of tariffs; our expectations of future increased business, revenues, and operating results; our ability to innovate and anticipate and address customer demands; our ability to increase production capacity, efficiencies, and quality; our underwriting and risk management; current and future customer orders and projects; our actual and planned investments; our expected cash generation and management; our capital allocation framework, including share repurchases and dividends; operational safety; our restructuring programs and strategies to reduce operational costs; and our credit ratings.

Forward-looking statements reflect our current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties, and other factors, which could cause our actual results, performance, or achievements to differ materially from current expectations. Some of the risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by forward-looking statements include the following:

- Our ability to successfully execute our lean operating model;

- Our ability to innovate and successfully identify and meet customer demands and needs;

- Our ability to successfully compete;

- Significant disruptions in our supply chain, including the high cost or unavailability of raw materials, components, and products essential to our business;

- Significant disruptions to our manufacturing and production facilities and distribution networks;

- Changes in government policies and priorities that reduce funding and demand for energy equipment and services;

- Shifts in demand, market expectations, and other dynamics related to energy, electrification, decarbonization, and sustainability;

- Global economic trends, competition, and geopolitical risks, including conflicts, trade policies, and other constraints on economic activity;

- Product quality issues or product or safety failures related to our complex and specialized products, solutions, and services;

- Our ability to obtain required permits, licenses, and registrations;

- Our ability to attract and retain highly qualified personnel;

- Our ability to develop, deploy, and protect our intellectual property rights;

- Our capital allocation plans, including the timing and amount of any dividends, share repurchases, acquisitions, organic investments, and other priorities;

- Our ability to successfully identify, complete, integrate, and obtain benefits from any acquisitions, joint ventures, and other investments;

- The price, availability, and trading volumes of our common stock;

- Downgrades of our credit ratings or ratings outlooks;

- The amount and timing of our cash flows and earnings;

- Our ability to meet our sustainability goals;

- The impact from cybersecurity or data security incidents;

- Changes in law, regulation, or policy that may affect our businesses and projects, or impose additional costs;

- Natural disasters, weather conditions and events, public health events, or other emergencies;

- Tax law and policy changes;

- Adverse outcomes in legal, regulatory, and administrative proceedings, actions, and disputes; and

- Other changes in macroeconomic and market conditions and volatility.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements, and these and other factors are more fully discussed in our Annual Report on Form 10-K for the year ended December 31, 2024, and in the Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, including in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operation" sections included therein, as may be updated from time to time in our SEC filings and as posted on our website at www.gevernova.com/investors/fls. We do not undertake any obligation to update or revise our forward-looking statements except as may be required by law or regulation. This press release also includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

Additional Information

GE Vernova’s website at www.gevernova.com/investors contains a significant amount of information about GE Vernova, including financial and other information for investors. GE Vernova encourages investors to visit this website from time to time, as information is updated, and new information is posted. Investors are also encouraged to visit GE Vernova’s LinkedIn and other social media accounts, which are platforms on which the Company posts information from time to time.

Additional Financial Information

Additional financial information can be found on the Company’s website at: www.gevernova.com/investors under Reports and Filings.

Conference Call and Webcast Information

GE Vernova will discuss its results during its investor conference call today starting at 7:30 AM Eastern Time. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the investor section of the website www.gevernova.com/investors. An archived version of the webcast will be available on the website after the call.

end

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 85,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Press Resources

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

Adam Tucker

GE Vernova | Director of Financial CommunicationsGE Vernova declares second quarter 2025 dividend

CAMBRIDGE, Mass. April 8, 2025 – GE Vernova (NYSE: GEV) today announced that its Board of Directors has declared a $0.25 per share quarterly dividend. The quarterly dividend will be payable on May 16, 2025, to shareholders of record as of April 18, 2025.

Future dividend declarations will be made at the discretion of the Board of Directors and will be based on GE Vernova’s earnings, financial condition, cash requirements, prospects, and other factors.

Additional Information

GE Vernova’s website at www.gevernova.com/investors contains a significant amount of information about GE Vernova, including financial and other information for investors. GE Vernova encourages investors to visit this website from time to time, as information is updated, and new information is posted. Investors are also encouraged to visit GE Vernova’s LinkedIn and other social media accounts, which are platforms on which the Company posts information from time to time.

Additional Financial Information

Additional financial information can be found on the Company’s website at: www.gevernova.com/investors under Reports and Filings.

Forward Looking Statements

This document contains forward-looking statements – that is, statements related to future events that by their nature address matters that are, to different degrees, uncertain. These forward-looking statements often address GE Vernova’s expected future business and financial performance and financial condition, and the expected performance of its products, the impact of its services and the results they may generate or produce, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “preliminary,” or “range.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about planned and potential transactions, investments or projects and their expected results and the impacts of macroeconomic and market conditions and volatility on the Company’s business operations, financial results and financial position and on the global supply chain and world economy.

end

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 85,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

Adam Tucker

GE Vernova | Director of Financial CommunicationsGE Vernova secures agreement to power 49 MW onshore wind project in Spain

-

GE Vernova’s Wind segment will provide eight onshore wind turbines to Forestalia

-

Deal features GE Vernova’s 6.1 MW-158m workhorse turbines

-

Project is part of 693 MW framework agreement signed in late 2023

COPENHAGEN, DENMARK (April 8, 2025) - GE Vernova’s Wind segment announced today that it has signed an agreement to provide Forestalia with eight of its 6.1 MW-158m* workhorse wind turbines to power a 49 MW wind project in Aragón, Spain. The deal, which was booked in the first quarter of 2025, is part of a framework agreement that the two companies first announced in December of 2023 to support the development of projects in the Aragorn region of Spain.

Spain has a goal of installing 62 GW of wind in the country by 2030, part of its plan to generate over 80 percent of its electricity from renewable resources by the end of the decade.

GE Vernova has a strong presence in Spain, accounting for 5.9 GW of the country’s wind capacity, including 1.5 GW in the Aragorn region. GE Vernova’s Wind segment also has a significant manufacturing footprint, including facilities in Ponferrada and Castellon.

Gilan Sabatier, GE Vernova’s Chief Commercial Officer of onshore wind, international markets said, “We are pleased to continue executing on our framework agreement with Forestalia as they work to help meet Spain’s wind energy goals. Our workhorse turbines are well suited to wind conditions in Spain and across Europe, as customers continue to look to wind power to meet energy demand, bolster energy security, and support renewable energy goals.”

Forestalia promotes, develops and builds projects in wind energy, photovoltaics, electric generation through biomass, and pellet production. Forestalia has driven and participates in a portfolio with an operational capacity of over 2 GW, with a socially responsible vision aligned especially with the rural areas where the facilities are located.

“Forestalia has a growing portfolio in operation and construction, which will exceed an installed capacity of 1.2 GW for direct management in the coming years”, says Carlos Reyero, Forestalia’s CEO.

Among the projects promoted and developed by Forestalia for construction and operation by other operators, notable ones include parks for Repsol, Copenhagen Infrastructure Partners (CIP), Lightsource BP and Bruc Management, totaling more than 4 GW, with the majority already in operation.

GE Vernova's Wind segment has a total installed base of approximately 57,000 turbines and more than 120 GW of installed capacity worldwide. Committed to its customers' success for more than two decades, its product portfolio offers the next-generation high-powered turbines at scale that drives decarbonization through high-quality, affordable, and sustainable renewable energy.

###

*Note to Editors: GE Vernova’s 6.1 MW turbine with a 158 meter rotor is what we refer to as the 6.1 MW-158m.

end

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 85,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future.

GE Vernova’s Wind segment is focused on delivering a suite of wind products and services to help accelerate a new era of energy by harnessing the power of wind. Technologies provided to customers include the next generation high efficiency 3-megawatt onshore wind turbine and the Haliade-X offshore wind turbine platform, as well as maintenance solutions and life extension optionality.

Forward-Looking Statements

This document contains forward-looking statements – that is, statements related to future events that by their nature address matters that are, to different degrees, uncertain. These forward-looking statements often address GE Vernova’s expected future business and financial performance and financial condition, and the expected performance of its products, the impact of its services and the results they may generate or produce, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “preliminary,” or “range.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about planned and potential transactions, investments or projects and their expected results and the impacts of macroeconomic and market conditions and volatility on the Company’s business operations, financial results and financial position and on the global supply chain and world economy.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Press Resources

GE Vernova onshore wind turbine at Loma de los Pinos, Sevilla, Spain

Image credit: Francis Tsang, for GE Vernova

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

GE Vernova to announce first quarter 2025 financial results on April 23

CAMBRIDGE, Mass. (April 7, 2025) – GE Vernova Inc. (NYSE: GEV) is scheduled to release its first quarter 2025 financial results on Wednesday, April 23, 2025, before market open. GE Vernova CEO Scott Strazik and GE Vernova CFO Ken Parks will discuss the company’s financial results in a webcast at 7:30 AM ET, which can be accessed at www.gevernova.com/investors/events/ge-vernova-1st-quarter-2025-earnings-webcast.

The earnings press release and supplementary financial information, including reconciliations of non-GAAP financial measures, will also be posted at the same link on the GE Vernova Investor Relations website. A replay of the call will be made available as a direct download on GE Vernova’s website at www.gevernova.com/investors/events.

Additional Information

GE Vernova’s website at www.gevernova.com/investors contains a significant amount of information about GE Vernova, including financial and other information for investors. GE Vernova encourages investors to visit this website from time to time, as information is updated, and new information is posted. Investors are also encouraged to visit GE Vernova’s LinkedIn and other social media accounts, which are platforms on which the company posts information from time to time.

end

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 85,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

Adam Tucker

GE Vernova | Director of Financial CommunicationsHomer City Redevelopment and Kiewit announce country’s largest natural gas-powered data center campus to support AI and HPC demand

-

Projected cost of power infrastructure and data centers will represent largest capital investment in the history of Pennsylvania

-

Facility will generate up to 4.5 GW of energy production powered by seven GE Vernova turbines; first turbine deliveries expected to begin in 2026

-

Will utilize the natural resources and differentiated legacy infrastructure of Pennsylvania to establish innovative data center campus and accelerate the state’s digital future

Homer City, PA (April 2, 2025) – Today Homer City Redevelopment (HCR) and Kiewit Power Constructors Co. (Kiewit) announced the future of the former Homer City Generating Station. Homer City – previously the largest coal-burning power plant in Pennsylvania – will be transformed into a more than 3,200-acre natural gas-powered data center campus, designed to meet the growing artificial intelligence (AI) and high-performance computing (HPC) needs of the innovative technology companies shaping America’s digital future.

View the full release here: https://www.homercityredevelopment.com/post/former-homer-city-pa-coal-plant-officially-reopens-as-state-of-the-art-natural-gas-facility

Renderings of the Homer City Energy Campus available here: www.homercityredevelopment.com

end

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 85,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future.

GE Vernova’s Gas Power business engineers advanced, efficient natural gas-powered technologies and services, along with decarbonization solutions that aim to help electrify a lower carbon future. It is a global leader in gas turbines and power plant technologies and services with the industry’s largest installed base.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

One Year Strong: Celebrating Our Independent Journey

April 2 marks the one-year anniversary of GE Vernova, a purpose-built innovation company dedicated to electrifying and decarbonizing the world’s energy system. Drawing on more than 130 years of experience tackling the world’s energy challenges, the company’s installed base produces about 25% of the world’s electricity, from wind and hydropower to gas-powered and grid solutions. The company built a solid foundation for a strong and sustainable future in its first year.

National Grid awards HVDC supply chain framework contracts

LONDON, UK (March 13, 2025) - National Grid today announced the awarding of two parts of a £59bn High-Voltage Direct Current (HVDC) supply chain framework to deliver the required works and equipment needed for key energy projects across the UK. The announcement sees four suppliers, including GE Vernova, being awarded places on the HVDC Converter Framework, totaling approximately £24.6bn. The agreement is applicable for a five-year period, with the potential to extend for a further three years.

Read the full press release here: https://www.nationalgrid.com/media-centre/press-releases/national-grid-awards-hvdc-supply-chain-framework-contracts

end

GE Vernova’s Grid Solutions business electrifies the world with advanced grid technologies and systems, enabling power transmission and distribution across the power grid, and supporting a decarbonized and secured energy transition.

Forward-Looking Statements

This document contains forward-looking statements – that is, statements related to future events that by their nature address matters that are, to different degrees, uncertain. These forward-looking statements often address GE Vernova’s expected future business and financial performance and financial condition, and the expected performance of its products, the impact of its services and the results they may generate or produce, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “preliminary,” or “range.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about planned and potential transactions, investments or projects and their expected results and the impacts of macroeconomic and market conditions and volatility on the Company’s business operations, financial results and financial position and on the global supply chain and world economy.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Press Resources

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

Anshul Madaan

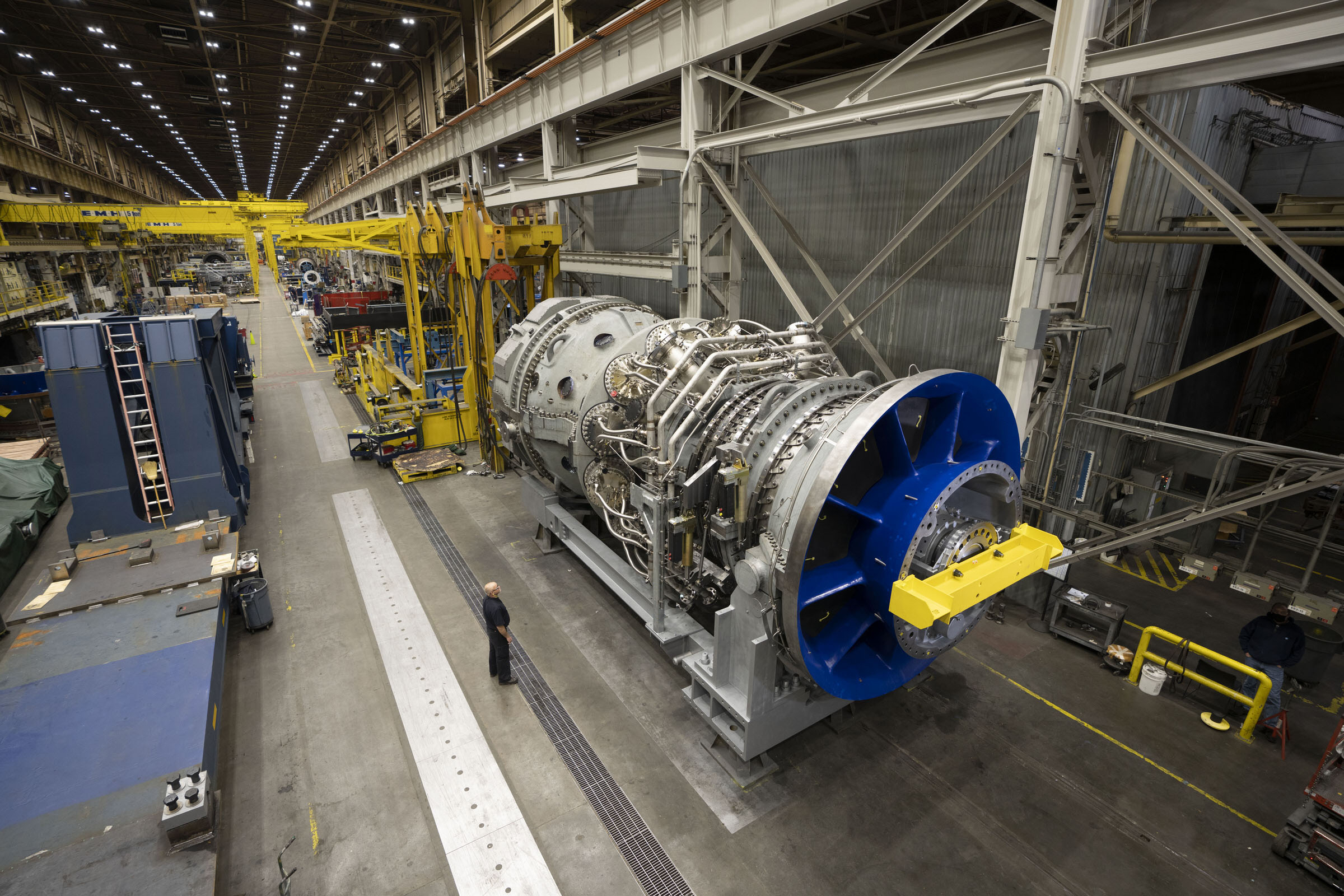

GE Vernova | Media Relations, ElectrificationGE Vernova’s H-Class gas turbine fleet accumulates three million operating hours

-

Industry leading technology continues to grow with a fleet of 116 units in operation, providing 67 gigawatts of electricity, which is the equivalent capacity needed to power more than 50 million U.S. homes

-

Company expanding capacity to help meet growing power generation demand, including more than $160 million investment in Greenville facility

-

The fleet is the most responsive and flexible in the industry enabling grid operators to dispatch power quickly and a great complement to intermittent renewable sources

ATLANTA, GA (March 6, 2025) – GE Vernova Inc. (NYSE: GEV) today announced that its industry leading H-Class gas turbine technology has amassed more than 3 million commercial operating hours across 116 units globally, the equivalent capacity needed to power more than 50 million U.S. homes. In addition to benefitting customers to provide efficient, dispatchable baseload power and supporting the energy transition, the growing fleet of operating HA gas turbines can provide significant value for GE Vernova through long-term maintenance and services contracts.

Since the first HA unit launched in commercial operations in 2016 with record-setting combined cycle efficiency, the HA fleet has generated more than 67 gigawatts (GW) of power, equal to one of these turbines running for 342 years, The fleet has helped power plant operators provide efficient electricity, reduce emissions, increase efficiency, retire coal-fired facilities, and integrate greater levels of renewable energy.

“This is an exciting milestone for the industry’s largest HA fleet,” said Eric Gray, President & CEO, GE Vernova’s Gas Power business. “Thanks to the strong collaboration with our customers, we are able to help them meet electrification and decarbonization goals with powerful and efficient technologies like the HA gas turbine. As more HA turbines come online, these milestones will only accelerate, while driving significant services for GE Vernova for decades to come and bringing greater reliability and operating performance for our customers.”

In addition to electrification, GE Vernova’s HA gas turbines have a pathway to decarbonization—both pre-combustion with hydrogen, with a current capability to burn up to 50% by volume of hydrogen when blended with natural gas, and post-combustion with carbon capture and sequestration. For example, at the new Net Zero Teesside Power project in the U.K., GE Vernova will supply a 9HA.02 turbine to power the world’s first commercial scale gas-fired power station with carbon capture.

In addition to traditional power generation and decarbonization, GE Vernova’s HA gas turbines are also well positioned for the growing need for more and larger, energy-intensive data centers. Recent agreements with Chevron and NRG and Kiewit are testaments to our commitment to accelerating new generation capacity to support demand growth and of the fleet’s broad appeal.

The International Energy Agency (IEA) estimates that data centers have the potential to double their energy usage by 2026. The rise of AI computational demand, along with the investment supercycle in electric power sector, has moved the IEA to raise its growth forecasts for global power. In its latest report, released in February, the IEA reported global electricity demand is expected to rise at a faster rate over the next three years, growing by an average of 3.4% annually through 2026. — one of the strongest sustained growth trajectories in many years.

To help meet this growing demand, GE Vernova announced more than $160 million investment in its Greenville, South Carolina, facility earlier this year. GE Vernova’s world-class manufacturing and services facility in Greenville will continue to represent the company’s largest gas turbine manufacturing plant and the HA Repairs Center of Excellence for the Americas Region, with the most powerful off-grid gas turbine validation facility in the world. This investment is focused on increasing capacity to help meet market needs, including plans to produce 70 to 80 heavy-duty gas turbines per year beginning in the second half of 2026 and shipping approximately 20 gigawatts annually starting in 2027.

end

GE Vernova’s Gas Power business engineers advanced, efficient natural gas-powered technologies and services, along with decarbonization solutions that aim to help electrify a lower carbon future. It is a global leader in gas turbines and power plant technologies and services with the industry’s largest installed base.

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Press Resources

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

GE Vernova and AWS expand collaboration to address accelerating global energy demand through strategic framework agreement

-

GE Vernova to support AWS data center scaling with Electrification technologies and Consulting Services

-

GE Vernova to support AWS's commitment to achieve net-zero carbon emissions by 2040

-

AWS to support GE Vernova’s cloud migration and digital innovation goals, including GenAI

CAMBRIDGE, Mass. (March 4, 2025) – GE Vernova Inc. (NYSE: GEV) and Amazon Web Services, Inc (AWS), an Amazon.com, Inc. company (NASDAQ: AMZN), today announced the signing of a strategic framework agreement (SFA) aimed at supporting AWS’s data center scaling, and collaborating to address increasing global energy demand, advance grid security and reliability, and decarbonize electric power systems.

Through this collaboration, GE Vernova will provide AWS with new offerings across a broad scope of solutions to electrify and decarbonize data centers across North America, Europe, and Asia, including:

- Electrification Systems: GE Vernova will continue to provide AWS with turnkey substation solutions to enable connectivity of AWS data centers to the grid, including expansion of major electrical equipment, project management, and construction support, across multiple sites globally. AWS and GE Vernova engineering teams will continue to work together to optimize data center substation design and delivery.

- Renewables: GE Vernova will collaborate with AWS to enhance the path for commercializing onshore wind development projects.

- Power Generation, Innovation and Services: GE Vernova and AWS will also explore additional opportunities for GE Vernova to provide power generation equipment and services to AWS as well as work with GE Vernova’s accelerator businesses – Advanced Research, Consulting Services, and Financial Services – to advance energy transition innovation, research, project development, and financing.

Pablo Koziner, Chief Commercial Officer, GE Vernova said, “We are excited to work in collaboration with AWS as they advance their computing capabilities and data center capacity. We believe that GE Vernova is well positioned through its broad portfolio of energy products and services to help AWS obtain reliable, cost effective, and more sustainable electricity for its data centers in support of their growth objectives. We appreciate the opportunity to work strategically with a company that embraces innovative solutions and values strong collaboration.”

Under this new collaboration, AWS will provide GE Vernova cloud services solutions to advance its cloud migration and digital innovation efforts, including through generative AI. AWS’s cutting-edge capabilities will support GE Vernova’s continued transformation as a standalone, public company as it enhances its systems and processes and further embeds sustainability and innovation into its core operations. The extended collaboration will introduce new potential technologies and cloud services, including AWS High Performance Computing (HPC). The collaboration will also help GE Vernova accelerate development cycles and optimize operations for advanced digital technology solutions through large computational power and cloud elasticity. AWS and GE Vernova will further work together to identify opportunities to accelerate GE Vernova’s operational goals, leveraging AWS technologies in artificial intelligence, big data, and data analytics.

Additionally, AWS will continue to collaborate with GE Vernova’s Electrification Software business to help support AWS Cloud deployments of software for the electric grid, power generation, and manufacturing industries.

“Through this expanded collaboration with GE Vernova, we’ll be able to accelerate data and energy efficiencies, driving reliable and more sustainable operations,” said Howard Gefen, general manager, energy & utilities, AWS. “Our shared goals of addressing increased global energy demand, advancing grid security, and decarbonizing electric power systems will help our customers across the globe.”

GE Vernova previously announced agreements to collaborate with AWS to help support cloud deployments of software to benefit electric utilities, energy organizations, manufacturers, and other industrial businesses. Through these collaboration arrangements, several of GE Vernova’s software solutions—including various applications within its GridOS® orchestration software portfolio, as well as Asset Performance Management—are hosted in the AWS Cloud.

Financial terms of this agreement are not disclosed.

###

About GE Vernova

GE Vernova Inc. (NYSE: GEV) is a purpose-built global energy company that includes Power, Wind, and Electrification segments and is supported by its accelerator businesses. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with approximately 75,000 employees across approximately 100 countries around the world. Supported by the Company’s purpose, The Energy to Change the World, GE Vernova technology helps deliver a more affordable, reliable, sustainable, and secure energy future. Learn more: GE Vernova and LinkedIn.

About Amazon Web Services

Since 2006, Amazon Web Services has been the world’s most comprehensive and broadly adopted cloud. AWS has been continually expanding its services to support virtually any workload, and it now has more than 240 fully featured services for compute, storage, databases, networking, analytics, machine learning and artificial intelligence (AI), Internet of Things (IoT), mobile, security, hybrid, media, and application development, deployment, and management from 114 Availability Zones within 36 geographic regions, with announced plans for 12 more Availability Zones and four more AWS Regions in New Zealand, the Kingdom of Saudi Arabia, Taiwan, and the AWS European Sovereign Cloud. Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—trust AWS to power their infrastructure, become more agile, and lower costs. To learn more about AWS, visit aws.amazon.com.

About Amazon

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon strives to be Earth’s Most Customer-Centric Company, Earth’s Best Employer, and Earth’s Safest Place to Work. Customer reviews, 1-Click shopping, personalized recommendations, Prime, Fulfillment by Amazon, AWS, Kindle Direct Publishing, Kindle, Career Choice, Fire tablets, Fire TV, Amazon Echo, Alexa, Just Walk Out technology, Amazon Studios, and The Climate Pledge are some of the things pioneered by Amazon. For more information, visit amazon.com/about and follow @AmazonNews.

Forward Looking Statements

Except for the historical and factual information contained herein, the matters set forth in this press release, including statements related to the benefits of the parties’ collaboration, the parties’ business outlook and potential future operations or transactions, and that may be identified by words such as “will,” “believes,” “expects,” “plans” and similar expressions, are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including the risks that the parties’ anticipated benefits from their agreement and continued collaboration may take longer to be realized or be less than currently anticipated, that the benefits of AI and other emerging technologies may take longer to be realized or be less than currently anticipated, or that certain of the parties’ plans for future changes may be more difficult or time consuming to implement than currently expected. Many of these risks, uncertainties and assumptions are beyond the parties’ control. Actual events and results may differ materially from those anticipated, estimated or projected if one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date made. Unless legally required, neither party undertakes any obligation and expressly disclaims any such obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

end

© 2025 GE Vernova and/or its affiliates. All rights reserved.

GE and the GE Monogram are trademarks of General Electric Company used under trademark license.

Press Resources

Investor inquiries

Michael Lapides

GE Vernova | Vice President of Investor Relations

Media inquiries

Rachael Van Reen

GE Vernova | External Communications, Electrification Software- Previous page

- Page 8

- Next page